Voluntary ESG reporting

SMEs must prepare for the transition to sustainability and evaluate the advantages of voluntary ESG reporting

Sustainability

Sustainability, which means the ability to meet the needs of the present without compromising the ability of future generations to meet their own needs, involves finding a balance between economic, social and environmental development in order to ensure that resources are being used intelligently and responsibly.

In this context, sustainability is a strategic matter for companies, which brings tangible benefits, but requires the involvement and commitment of management and the promotion of ethical and responsible models, with profound changes in company culture and processes.

Investment in sustainability will lead to a guaranteed positive return, as it will bring benefits such as:

- Compliance with legislation and sector standards

- Access to funding (private, public or European)

- Access to investors and partnerships

- Lower risk

- Brand reputation and offer placement

- Relationship with key audiences

Adoption of ESG criteria

In the context of sustainability, the acronym ESG refers to Environmental (E), Social (S) and Corporate Governance (G) criteria.

The adoption of ESG criteria involves concrete actions such as:

- Environmental: Reducing their energy and water consumption, recycling and reusing materials, and using sustainable products and services.

- Social: Offering employment and training opportunities to disadvantaged people, promoting diversity and inclusion, and supporting social causes.

- Governance: Implement risk management and compliance systems, promote transparency and ethics, and respect human rights.

European regulatory tendencies in the field of sustainability

Sustainability has long been at the center of international political agendas. At European level, there has been a significant increase in regulatory initiatives:

- Taxonomy (EU Taxonomy)

- Climate law

- Corporate Sustainability Due Diligence (CSDD) Directive

- Revision of Directive 2014/95/EU on the reporting of non-financial information on sustainability by companies (Corporate Sustainability Reporting Directive - CSRD)

- EU sustainability reporting standards (ESRS)

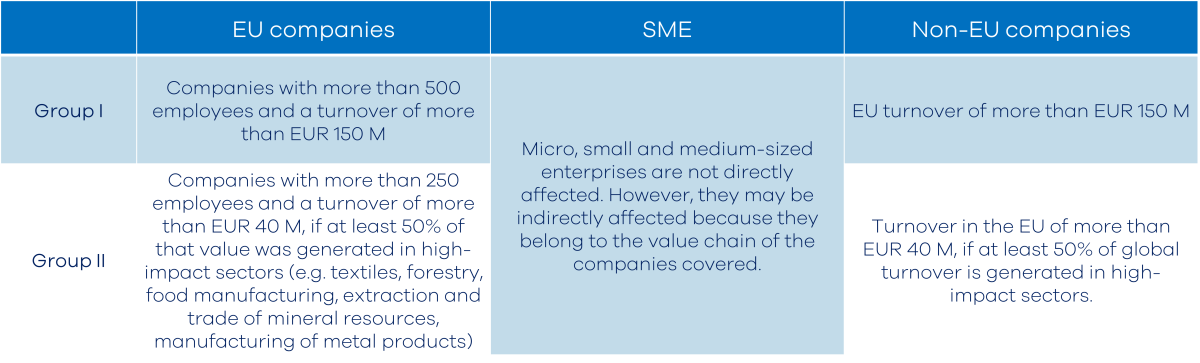

The European Commission has approved a proposal for a directive on sustainability and corporate due diligence (Corporate Sustainability Due Diligence). Its scope focuses on company operations, subsidiaries and the value chain (direct and indirect business relationships), as summarized below:

The new European Corporate Sustainability Reporting Directive (CSRD) will follow the following schedule of reporting obligations:

- Fiscal year 2024 (report 2025): organizations already covered by the non-financial reporting directive

- Fiscal year 2025 (2026 report): large companies that are not yet covered by the non-financial reporting directive

- Fiscal year 2026 (report 2027): Listed SMEs, small and non-complex credit institutions and insurers; listed SMEs with a 2-year opt-out option;

- Fiscal year 2028 (report 2029): "non-EU" companies (article 40 a-d EU accounting directive)

Voluntary reporting for unlisted SMEs

These proposals will encourage more sustainable and responsible business behavior throughout the value chain (e.g. supplier network).

Although they are not formally on the list of entities obligated to report on sustainability practices, most SMEs will have to be able to respond to the indicators requested of them by the companies covered and they will be penalized in terms of access to financing, company reputation, resilience to external shocks and contribution to social challenges.

For this reason, EFRAG (European Financial Reporting Advisory Group) is working on a proposal for voluntary reporting standards aimed at unlisted SMEs.

This voluntary scheme will help these companies to present their sustainability report, on an annual basis and on an individual or consolidated basis. This report will be contained in a separate section of the management report and may consist of up to 3 modules:

1. Basic module: B1, B2 and basic metrics B3-B11. This is aimed at micro-enterprises and is a minimum requirement for other companies. It does not require materiality analysis. This module will report:

- B3 - consumption by source, MWh, and GHG emissions, tCO2eq (scopes 1 and 2). CH4 and N2O can be disregarded;

- B4 - air, water and soil pollution (applicable to companies with the environmental regime for industrial emissions and/or reporting under EMAS);B5 - biodiversity (for World Heritage companies, etc.);B6 - water (water consumption and abstraction in water-stressed areas);

- B7 - use of resources, circular economy and waste management;B8 - workforce (FTE by type of contract, gender and country);

- B9 - staff health and safety (accidents at work and fatalities);

- B10 - remuneration, training and collective work contracts;

- B11 - corruption and bribery fines.

2. Narrative module: defines N1-N5 disclosures in relation to policies, actions and targets to be reported if the company has implemented them. Materiality analysis is required to disclose which of the sustainability topics are relevant to the business. In addition, ESG principles are reported after conducting a dual materiality analysis (sustainability matter), impact (inside-out) and financial (outside-in), to Appendix B List of Sustainability Matters used for Materiality Assessment.

3. Business partner module: defines the datapoints that are likely to be included in data requests from creditors, investors and customers. The materiality analysis is necessary to limit the report to only those topics that are relevant to the company.The basic module is a prerequisite for modules 2 and 3. However, the company can select only module 1; 1 + 2; 1 + 3 or 1, 2 and 3.

Classified, sensitive information, Intellectual Property or the result of innovation must be safeguarded and the company must omit it, indicating this in B1.

How can STREAM add value?

STREAM supports SMEs in the strategic planning and implementation of the most relevant actions for the adoption of ESG criteria, from the verification of missing processes, through the relationship with their stakeholders, to the definition of action plans and the creation of a corporate ESG culture.

STREAM will also help with understanding sustainability issues, analyzing materiality, assessing impacts, risks and opportunities, complying with reporting requirements and preparing the company's sustainability report.

In addition, STREAM will identify, understand and prioritize financial incentives or tax benefits to generate environmental, governance and social (ESG) benefits for the entity.

For more information, see: https://efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FMeeting%20Documents%2F2305101045339288%2F03-02%20EFRAG%20SR%20TEG%20231108%20VSME%20ESRS%20ED%20clean.pdf